Windhaven Insurance insures lots of Florida drivers.

Here, I’ll share my thoughts on claims and settlements with Windhaven Insurance. You’ll also get to see my Windhaven car accident settlements.

Expect Windhaven to Have No Bodily Injury Liability Insurance on the Policy

A Windhaven auto property damage claims adjuster told me that almost all Windhaven policies don’t have bodily injury liability (BIL) insurance. I asked him about Windhaven insurance policies in Florida.

Specifically, he told me that about 98% of Windhaven Florida car insurance policies don’t have BIL insurance. That is terrible!

And it’s not necessarily Windhaven’s fault. Many people can’t afford BIL insurance. Or it’s simply not a priority to them.

Moreover, he said that if a Windhaven car insurance policy has BIL coverage, it is usually for $10,000 per person/$20,000 per accident.

This is very similar to car insurance policies with other non-standard insurers like United Automobile Insurance Company, Ocean Harbor, Direct General, Responsive and others.

What does this mean for injured people?

If Windhaven insures a driver who caused your accident in Florida, there will likely be little or no bodily injury (“B.I.”) liability insurance to cover your injuries.

This is because, in my opinion, car owners that buy insurance with Windhaven Insurance do it mainly just to comply with Florida’s minimum insurance requirements.

In Florida, bodily injury insurance is not required on personal cars.

If Windhaven insures a driver who caused your crash in Florida, and he/she has BI liability insurance, it will likely be in the amount of $10,000 per person/$20,000 per accident.

If you’re badly injured, this isn’t enough to pay for your out of pocket medical bills, lost wages and pain and suffering.

Will There Be Uninsured Motorist (“UM”) Insurance on Windhaven Policies?

The odds are No.

Windhaven often sells policies with little to no BI liability insurance. Therefore, there likely won’t be uninsured motorist (“UM”) insurance on a Windhaven policy.

Windhaven Is More Likely To Deny PIP or BIL Insurance Coverage

Just because a driver has a Windhaven Insurance card at the accident scene, it doesn’t mean that Windhaven will automatically cover the accident. Windhaven, like all insurance companies, will conduct a coverage investigation to see if there is coverage for your accident.

Windhaven will make sure that the insured honestly completed the application.

If you speak with personal injury lawyers in Florida, many will say that Windhaven has a reputation for denying coverage more often than other insurance companies like State Farm, GEICO and Progressive.

Additionally, Windhaven is cheaper than most other car insurance companies. I’m talking about paying injury claims. For example, Windhaven is cheaper than USAA, Travelers Insurance, and many other car insurers.

Windhaven may deny coverage if its insured, in the insurance application:

- Failed to list all residents in the household who are 15 or older; or

- Gave the wrong residence address and it resulted in them paying less for car insurance

What Can You Do If Windhaven Isn’t Acting Fairly?

If Windhaven isn’t handling your claim in good faith, you can file a consumer complaint with the Florida Department of Insurance.

I have filed a consumer complaint against Windhaven. That complaint was for a PIP claim, where I claimed that they were not acting properly. Specifically, I claimed that Windhaven did not respond to my calls, emails or faxes.

Additionally, I claimed that Windhaven didn’t send me the written requested required insurance information as required by Florida Statute 627.4137. Without that disclosure, I did not know whether PIP, medical payments coverage and/or uninsured motorist coverage was available.

I also claimed that Windhaven failed to pay my client’s hospital bill.

Filing a consumer complaint is much more effective than complaining to the Better Business Bureau (BBB).

Why?

Because the Florida Department of Financial Services can fine Windhaven is they don’t respond to the complaint. I’m not sure that the BBB can do much in terms of fines.

Windhaven Pays $8K of $33K Settlement for Hip (Acetabular) Fracture

On July 30, 2018, Shankeva was a passenger in her boyfriend’s car in Holly Hill, Florida.

Another driver (vehicle 1) hit another car (vehicle 2) head-on. Vehicle 2 then struck the car that Shankeva was in.

Windhaven Insurance Company insured Vehicle 1.

Shankeva suffered an acetabular fracture. An acetabular fracture is a break in the socket portion of the “ball-and-socket” hip joint.

Wisely, she hired me days after her accident.

Sadly, another driver died in the crash.

Driver Insured by Windhaven Only Had $10K Per Person in BIL Insurance

Unfortunately, since the vehicle that Windhaven insured only had $10,000 per person/$20,000 per accident in bodily injury liability (BIL) coverage.

To make matters worse, there were 2 injured people and the family (of the driver who was killed) making claims. All three parties were competing for the $10,000 “per person” benefits. Each had an attorney.

Windhaven made the decision to pay the $20,000 per accident BIL insurance limits. The money was split up during a mediation. Windhaven hired a Tampa attorney to represent it.

Windhaven Paid $10K to Family of Driver Who Was Killed

$10,000 went to the family of the lady who was killed on impact. As you can imagine, the value of a death case is worth much more than most fracture cases. Juries often award millions for a wrongful death claim.

This means that settlements for a spouse, child or parent of someone who is killed are often in the million dollar range.

Basically, we had to decide how to divide the remaining $10,000 between my client and the driver of the car in which she was a passenger. I argued that my client should get $8,000.

Ultimately, the driver’s attorney agreed to this. He accepted $2,000.

Fortunately, my client was in a car that had uninsured motorist (UM) insurance. State Farm was the UM insurer.

Within 30 days of the accident, State Farm paid us Shankeva’s boyfriend’s $25,000 uninsured motorist insurance limit.

Therefore, I got Shankeva a $33,000 personal injury settlement. Most of the settlement was for pain and suffering.

Fortunately, she is doing much better now. She did not need surgery. Surgery increases the full value of a case.

However, even if she would’ve had surgery, her settlement would not have been bigger.

Why not?

Because there was limited insurance available. And the driver of vehicle 1 was likely uncollectible.

This is one of my many personal injury settlements.

$10K (of $20K) Settlement with Windhaven for Injury Claim

Sara (not real name) claimed that a driver of a car made an improper lane change. Sara claimed that the other driver crashed into her SUV.

Sara’s car rolled over. All things equal, rollover accidents are usually worth more than accident cases where the vehicle doesn’t flip.

Therefore, rollover accidents tend to get higher personal injury settlements than most rear end accidents.

Sara hired me (a Miami car accident lawyer) for her personal injury claim.

We claimed that the accident caused or aggravated her herniated disc, ACL sprain/tear. Additionally, she had some minor soft tissue injuries.

Windhaven insured the driver who got a ticket for making an improper lane change.

Sara claimed that the accident caused or worsened a:

- L5-S1 broad-based posterior disc herniation with posterior annular tear and bilateral facet hypertrophy indenting the thecal sac and moderately narrowing the bilateral neural foramen right worse than left.

- a sprain/interstitial tear of anterior cruciate ligament (ACL) in her knee

GEICO Insured Sara With $10K of Underinsured Motorist (UIM) Insurance

GEICO insured Sara’s with $10,000 in non-stacking underinsured motorist (UIM) insurance. They have a better reputation (than Windhaven) for personal injury claims.

GEICO paid this $10,000 UIM limit around the time that the ticketed driver’s bodily injury liability insurer, Windhaven, paid its $10,000 limit.

Windhaven Pays $10,000 in PIP Benefits for Passenger Hit by Drunk Driver

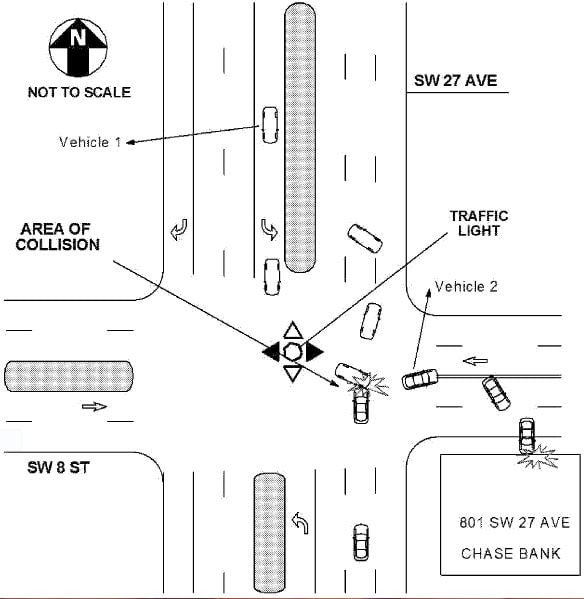

The above diagram is from an actual crash report. After the crash, Windhaven paid $10,000 in Personal Injury Protection (“PIP”) benefits toward a passenger’s, Erika’s, medical bills.

A drunk driver (Vehicle #1) crashed into the car that Erika was in (Vehicle #2; the “host car”).

Windhaven insured the host car. Erika qualified for the host car’s PIP because Erika didn’t own a car, and didn’t live with a resident relative who owned a car.

Although Windhaven paid the $10,000 in PIP benefits, Windhaven denied BI liability insurance coverage because the host car’s driver was an excluded driver on the policy.

Erika’s injuries included back pain and leg pain. State Farm insured the drunk driver.

State Farm paid $25,000 to settle Erika’s personal injury case. I represented Erika.

Windhaven Pays $10,000 Towards Driver’s Medical Bills (Car Accident)

The car in the photo above was in a car accident in Homestead, Florida. Windhaven insured Greg, who owned the car and was driving it when the crash happened.

A truck cut Greg off. Windhaven paid $10,000 in PIP benefits to Greg’s medical providers.

Zurich Insurance Company insured the truck. Zurich is the same company who insures Lyft cars.

Greg claimed that the car accident caused or aggravated a herniated disc in his neck.

Greg settled his personal injury claim with Zurich for $100,000. I represented Greg.

Windhaven Has a High Percentage of Consumer Complaints

In 2014, Windhaven insured 1.3% of all private passenger cars in Florida. However, their complaint share was 9.2%. This is a bad sign for people injured in accidents involving Windhaven.

I want to represent you if you were hurt in an accident in Florida.

Call Me Now!

Call me now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if I Do Not Get You Money

We speak Spanish. Learn more about us. Check out my law firm reviews.

Leave a Reply