In May 2019, Mary (not real name) was walking as a pedestrian in a parking lot in Miami, Florida. Sofia was driving a car. Sofia’s car hit Mary. Progressive insured the driver. The driver of the car called 911. Paramedics came to the scene.

She complained of pain to her leg and face (around her eye). Her glasses broke in the fall. They took Mary to the hospital.

They took a CT scan of her head. However, it did not show that she had a head injury.

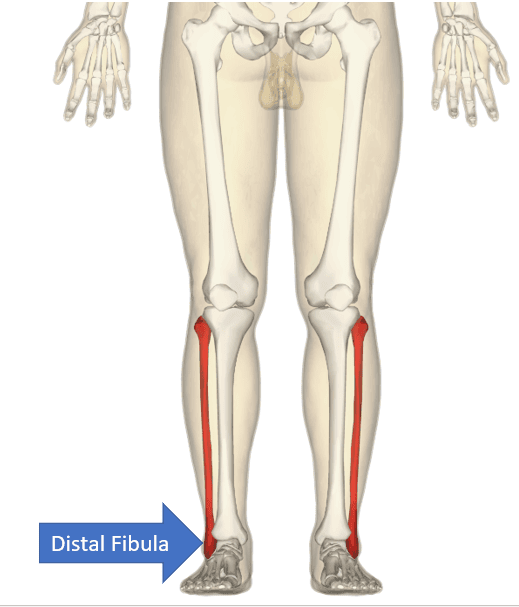

She Broke Her Ankle

Ultimately, an x-ray showed that she had a fracture of the distal fibula.

This is the part of the smaller lower leg bone that is closer to the ankle. Basically, she had an ankle fracture. Fortunately, she did not need surgery.

Mary’s relative searched for Miami car accident attorneys. She saw my many awesome personal injury settlements with Progressive. In one of those cases, Progressive settled with me for $100,000 after a pedestrian was hit by a car.

Sure, I’ve had much bigger personal injury settlements. However, her relative wanted an attorney who had settlements for a pedestrian who was hit by a car (that was insured with Progressive).

But that was not it. Additionally, I settled another case for $65,000 where a pedestrian was hit by a car and broke his ankle. She also saw our 5 star rating on Google maps. She called me and got a Free consultation to see if I could represent her relative. Next, she recommended to Mary that she hire me.

Mary called me. After we spoke, she immediately hired me.

I quickly jumped into action. We requested Progressive’s bodily injury liability insurance limits. In addition, I requested the audio recording of the 911 call.

Here’s What the Driver Said to the 911 Operator

On the call, the driver said that she had an accident. The driver said:

I hit somebody.

Driver who hit my client

Then, she was asked:

Did you hit another car or another person?

Sofia replied:

I hit somebody. The lady. She walked into my car.

The audio quality was a little poor. I could not tell if Sofia said she walked “into” or “through” my car.

Progressive’s First Offer Was $50K

Progressive initially assigned bodily injury liability adjuster David Toro to handle the claim. We told Progressive to pay for Mary’s broken eye glasses. They paid for a new pair.

David offered us $50,000 to settle Mary’s bodily injury claim. We refused it. Later, Progressive assigned large loss/litigation adjuster Greg Paulson to the case. Greg increased Progressive’s offer to $55,000.

He told me that he did not see her claim as being worth $100,000 for several reasons. First, he blamed Mary for walking in front of his insured’s car. I disputed this by providing Greg with a photo of the accident scene. It showed that the driver had a clear line of sight and should not have hit Mary.

Second, Progressive argued that Mary did not have surgery to her ankle. As I have said throughout my website and blog, surgery greatly increases the full value of the case. Full value is the value before discounted a case for liability issues and fault on the injured person.

Greg told me that he felt that the claim was worth somewhere around $75,000. I aggressively negotiated this claim with Progressive. Finally, Greg increased his offer to $90,000.

I knew that this offer was fair because I know the settlement value of broken leg. In November 2019, we settled the bodily injury case with Progressive for $90,000.

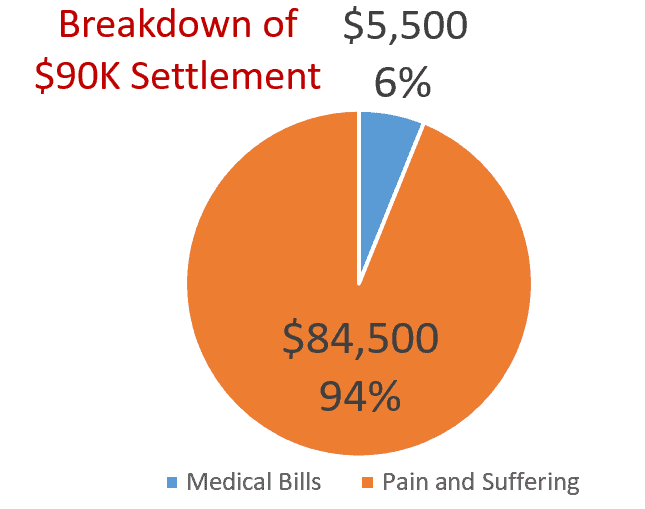

95% of the Settlement Was for Pain and Suffering

Here is a pie graph that shows the breakdown (of the settlement) between pain and suffering and medical bills:

As you can see from the pie graph above, 95% of the settlement was for pain and suffering. About 5% of the settlement was for medical bills. This case is yet another example showing that pain and suffering is often the biggest part of a settlement.

After my contingency fees and costs, paying Mary’s out of pocket medical bills and health insurance lien, she gets over $54,000. That is her portion of the settlement.

Since Mary owned a car, she used her Personal Injury Protection (PIP) coverage to pay for her medical bills. United Auto Insurance Company (UAIC) was Mary’s auto insurer. Her out of pocket medical bills were low because United’s PIP paid for $10,000 of her medical bills.

We Didn’t Have to Sue To Get the $90K Payout

We got this payout without having to sue. This benefited Mary because my attorney’s fee was capped at 33 1/3% of the total settlement. If I would have sued, my attorney’s fee would have shot up to 40% of the settlement. Also, my client avoided the stress and increased costs associated with a lawsuit. I do not sue just to drive up my fees.

Make no mistake about it. I sue. In fact, I have sued drivers insured by Progressive, Allstate and other insurance companies before. However, I consider my client’s best interests before suing.

My client is very happy with the settlement.

What if Sofia Would Have Been Driving for Uber or Lyft?

How would this case been different if a rideshare vehicle would have hit my client?

Let’s assume that Sofia was not driving her car for pleasure. What would have happened if she hit a pedestrian while driving for Uber or Lyft?

In that instance, Uber and Lyft’s insurance policies each provide for at least $50,000 in bodily injury liability (BIL) coverage per person. This applies if the Uber or Lyft driver had the app on, but was not engaged in a ride. The most that Uber would have paid to settle the injury claim would have been $50,000. Similarly, Lyft would have settled this personal injury case for $50,000.

If the Uber or Lyft driver was en route to pickup passengers or during trips, BIL coverage jumps to $1 million per accident.

If you have had a similar accident or injury in Florida, I would love to represent you. Get your free consultation right now by completing this short form. Or you can call me at 305-661-9977 twenty four hours a day, seven days a week.

Do you think about this $90,000 settlement was fair? Let me know why in the comments below. Feel free to also ask me any questions or leave any other comments about this settlement.

Leave a Reply