Breaking News: For accidents starting on March 30, 2020, Lyft’s certificate of liability insurance shows no uninsured motorist coverage.

I’m talking about accidents in Florida. The acronyms UM/UIM (uninsured/underinsured motorist) are no longer on Lyft’s Florida certificate of liability insurance.

This will greatly affect many Lyft drivers and passengers for accidents beginning March 30, 2020. Let me give you an example how.

A few years ago, I settled a Lyft passenger’s case for $70,000. If that accident happened today, he would have only gotten a $25,000. That’s a $45,000 loss! We’re talking about a huge drop in settlement value.

I don’t know what Lyft has done for other states for this time period. However, Lyft’s certificate of insurance is on its website.

Lyft Accidents that Occurred Between May 1, 2019 and March 29, 2020

On September 21, 2018, Lyft made two big changes in regards to its car insurance.

The biggest change is that Lyft lowered the amount of its uninsured motorist insurance coverage when a Lyft is engaged in a ride. I’ll get to the new lower amount in one moment.

The term engaged in a ride covers the period from when a Lyft rider accepts a ride until the rider is dropped off.

Uninsured motorist coverage covers Lyft drivers and passengers if an uninsured vehicle negligently hits a Lyft car. Uninsured motorist insurance also applies if the other vehicle was underinsured.

Lyft used to have $1 million in uninsured motorist insurance coverage. This was impressive. In fact, I was shocked when I learned (years ago) that Lyft and Uber both had $1 million coverage.

I was shocked because Lyft and Uber aren’t required to have any uninsured motorist coverage. At least not in Florida.

As a comparison, taxis (in Florida) usually don’t have uninsured motorist insurance coverage.

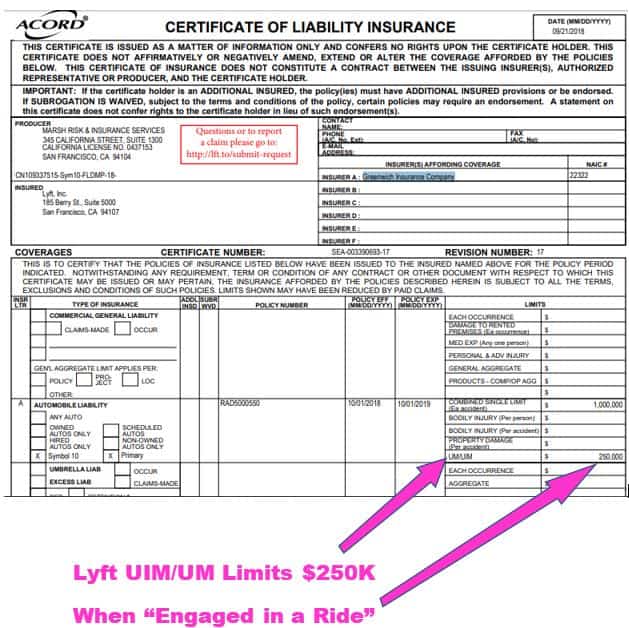

On September 21, 2018, Lyft lowered its uninsured to $250,000 per accident. Here is Lyft’s certificate of liability insurance for Florida.

Lyft uses a different certificate of liability insurance for each state.

This lower uninsured motorist insurance limit applies for accidents starting September 21, 2018 in Florida. Therefore, it won’t affect accidents that occurred before September 21, 2018.

$250K Uninsured Motorist Limit Won’t Affect Most Claims

This new $250,000 uninsured motorist limit won’t affect most Lyft claims. This is because most Lyft accident claims are worth way under $250,000.

For example, your typical broken (without surgery) isn’t going to result in a $250,000 settlement. Neither will run of the mill back pain or neck pain. Likewise, most herniated discs won’t get a $250,000 settlement.

Which claims will Lyft’s $250,000 uninsured motorist (UM) insurance affect?

It will affect Lyft drivers or passengers who suffer more serious injuries. I’m referring to:

- a broken leg with surgery.

- a brain injury.

- death of a anyone (minor child, parent, or spouse)

- an injury with more than 1 surgery and high medical bills

- a shoulder labrum tear with surgery and a big workers compensation lien

- A femur fracture with surgery

- A tibial plateau fracture with surgery

With injuries like those, and the other driver at fault, Lyft’s insurance company may be much quicker to pay the $250K uninsured motorist insurance limit.

This is because the pain and suffering settlement value of those injuries is often over $250,000. Then, you add in medical bills and lost wages.

If Lyft’s insurance company doesn’t pay the $250,000 UM limits on a big injury, they run the risk of owing above the $250,000 limit. This assumes that they acted in bad faith. It also assumes the the injured person filed a civil remedy notice of insurer violation.

Insurance companies hate owing more than the insurance policies.

Lyft is Now Insured with Greenwich Insurance Company

The second big change with Lyft insurance is that its switched insurance companies.

Zurich American Insurance Company no longer insures Lyft cars (in Florida). I just practice in Florida, which is why I focus on Lyft insurance in Florida.

However, out of curiosity, I checked another nearby state. Sure enough, Lyft no longer uses Zurich for that state either.

Who is Greenwich Insurance Company?

Greenwich Insurance Company is part of AXA XL.

Who is AXA XL?

AXA recently purchased XL Group Ltd for $14.9 Billion dollars. That’s no small potatoes.

XL Group handled personal injury claims. They likely handled other types of claims as well.

After AXA bought XL Group Ltd, it became known as AXA XL.

There are Few Settlements with AXA XL Online

If you browse the internet, you won’t find many injury settlements with AXA XL insurance. Most car accident settlements in Florida are not with XL. However, we’ll soon find out if AXA XL pays fairly.

My guess is that they may be an average insurer. Hopefully, AXA XL is as reasonable as Zurich.

I like Zurich. They aren’t the best. But you can do much worse. I’ve settled many personal injury claims with Zurich.

One of those claims was a Lyft passenger’s uninsured motorist settlement with Zurich for $45,000. GEICO paid $25,000. The whole settlement was for $70,000.

After all, AXA XL likely can’t be worse at paying for accident claims than Progressive. (Unfortunately, Progressive insures Uber in Florida).

When Zurich insured Lyft (in Florida), they used York Risk Services for their claims. I don’t yet know if Lyft is still using York for its Florida claims. As soon as I find out, I will update this article.

Lyft’s Uninsured Motorist Insurance is Excess Over Any Other Uninsured Motorist Insurance

If you make a uninsured motorist insurance claim with Lyft, Lyft’s insurance company will likely tell you that Lyft’s Underinsured Motorist policy is excess over any other collectible UM/UIM insurance. \

Lyft will ask you to confirm if you have an auto policy. If you had car insurance, you’ll need to complete an affidavit saying whether you had uninsured motorist insurance.

If you didn’t have an auto insurance policy, York will ask you for a signed affidavit of no UM coverage or a UM coverage denial from your insurance company. Otherwise, York won’t pay you UM benefits.

Bottom Line:

Lyft passengers and drivers should be grateful that Lyft still has uninsured motorist coverage on its policy. In my eyes, this is a gift. And one that likely won’t last long.

I expect Lyft to eventually drop its uninsured motorist coverage from its insurance policy. But that talk is for another day.

Were you injured in a Lyft accident in Florida? Or another type of accident?

I want to represent you!

My Miami injury law firm represents people injured anywhere in Florida.

Call Us Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.

Leave a Reply