This is the ultimate guide to rear end collision settlements and claims in 2023.

As a rear end accident lawyer, I’ll give you inside tips that I’ve learned over my 19 year career.

I’ll share some interesting injury settlements for some of my rear-end collision cases. Some settlements are from 2022 and others are from earlier years.

That’s not all…

I’ll discuss which facts helped get a bigger settlement, and which factors decreased the settlement amount.

We’ll also discuss how to know when the rear driver in a rear end collision is liable for personal injury to the driver of front car.

Let’s start off by looking at some frequently asked questions (FAQs) about rear end accidents.

It depends on many factors. However, the biggest two factors are often how badly you are hurt, and the amount of available insurance.

In most rear end accidents, the person who is rear ended is not badly injured. And in many cases where he or she is seriously hurt, there is limited insurance available.

The average rear end car accident settlement is likely under $15,000.

That said, some rear end accidents can lead to bigger payouts. For example, in 2019, I settled a rear end accident case for $170,000. My client was a passenger in a car that rear ended another car.

You can see a photo of my client’s broken arm (humerus) in a sling.

Most of the time it depends on how badly you are injured, and the amount of the available insurance policy limits.

If you are seriously hurt, and the available policy limits are small, you will likely get a faster settlement. This is because, in states like Florida, the insurance company faces pressure to pay. If the insurance company does not pay when it could and should, it may owe more than the policy limits. Insurance companies do not like to pay above the limits.

If you have injuries that are worth more than the policy limits, you could get a settlement in just one or two months.

However, you (or your lawyer) also need to make sure that you know how much you may owe your medical providers and/or health insurance company. Figuring this out may add additional time to any settlement.

On the other hand, if you have a small injury, and the available insurance policy limits are high, then the case will usually take longer to settle. In this instance, you’ll likely need to wait to settle until you have finished your medical treatment.

Yes, however it is not likely. Most rear end car accident cases settle for much less than $200,000.

Generally speaking, you need to have surgery for an insurance company to offer you more than $100,000. Of course, you can find examples of rear end collision cases that settled above $100,000 without surgery.

However, this rule applies in most rear end car accident claims.

In this video, I talk about rear end collision settlements:

Table of contents

- Rear End Accident Lawyer Gets $210,000 Settlement

- Rear End Accident Lawyer Gets a $170,000 Settlement

- $100,000 Rear End Collision Settlement in 2022

- $100,000 Settlement for Back Injury from Rear End Collision

- $100K Settlement (Truck Crashes Into Back Of Her Car)

- $70K Rear End Collision Settlement (Lyft Accident)

- GEICO sent me the $25K limits in just 1 month!

- Driver Gets $65K Settlement for Rear End Car Accident

- $57K Rear End Car Accident Settlement

- His Doctor Gave Him Epidural Shots

- Rear End Accident Lawyer Gets $30K Settlement

- Rear End Collision Lawyer Gets $28K Settlement

- $28K Settlement For After Tractor Trailer Driver Rear Ends Truck

- First Medical Treatment was 6 Days After the Crash

- Do you want me to fight the insurance company for you?

- $25,000 Payout for Rear End Car Accident (In Just 30 Days!)

- $20K Settlement for Rear End Car Accident

- Take Photos if Paramedics Put a “C-Collar” on Your Neck

- $17K Rear End Accident Settlement

- $10,000 Rear End Car Accident Settlement

- Rear End Car Accident Lawyer Gets $10K Settlement

- Rear End Accident Lawyer Gets $10K Settlement

- Example 1- Typical Rear End Accident

- Example #2 – Rear Car Says Front Car Slammed on Brakes

- How much are Uber and Lyft rear end accident cases worth?

- Why Rear-End Crash Big Rig Cases Are Different

- Rear End Accident Lawyer Wins $244K for Family of Passenger, and $75K for Driver

- Court Lets Motorcyclist’s Case Go to Trial Where Motorcyclist Rear Ends Car after Car Cuts in Front and Slams on Brakes

- Court Puts Zero Blame on Front Car in Rear End Crash

- I Want to Be Your Rear End Accident Lawyer in Florida

Rear End Accident Lawyer Gets $210,000 Settlement

A truck driver was rear ended by another truck. He claimed that the crash caused or aggravated his shoulder joint (labrum) tear. Additionally, he also claimed that the crash caused or aggravated his 3 herniated discs.

He had shoulder surgery. He searched for a rear end accident lawyer and he found me. I gave him a free consultation to see if I could represent him. We met in my office and he hired me.

Travelers was the trucking company’s insurer. Their first offer was just $25,000!

Ultimately, they paid $200,000 to settle his personal injury case.

Fortunately, he also had uninsured (UM) motorist insurance on his personal car. Progressive was the UM insurer. They paid $10,000 to settle his uninsured motorist insurance case.

I settled this personal injury case for $210,000. This chart shows the comparison between the first offer and the settlement:

It gets better.

My client, the injured driver, was working at the time of the accident. His workers’ compensation paid about $88,430 for his medical bills and part of his lost wages.

Why does this matter?

They wanted to get paid back for this amount ($88,430). I got them to accept $19,250 to settle their workers’ compensation lien.

This put much more money in my client’s pocket. Take a look:

I estimate that about 90% of the $210,000 rear end accident settlement was for pain and suffering.

The $210,000 settlement was about 10 times my client’s final out of pocket medical bills and the workers’ compensation payback amount.

In other words, the pain and suffering multiplier was about 10.

That case is one of the few examples of a rear end collision settlement that is over $200,000.

Let Me Fight to Get You a Fair Settlement

Rear End Accident Lawyer Gets a $170,000 Settlement

Watch this video about this settlement:

Zach was a passenger in a rental car in Sarasota, Florida.

The driver of the rental car that Zach was in rear ended the car in front of them.

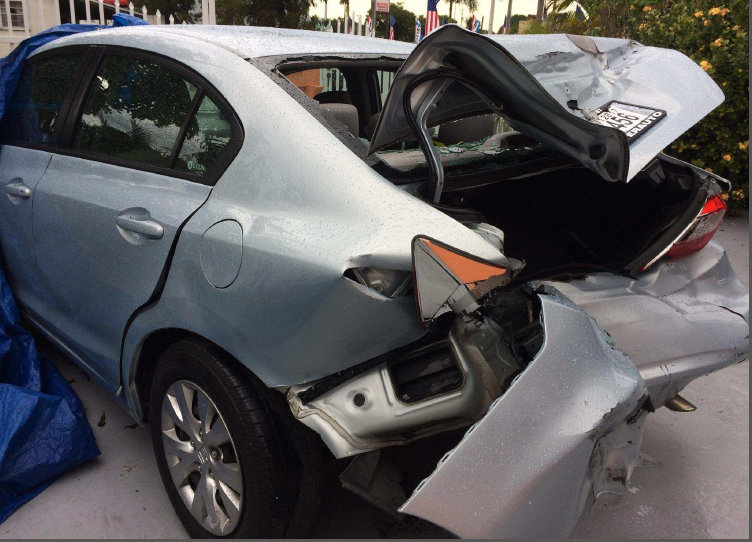

You can see the damage to the rental car:

Unfortunately, Zach broke his upper arm bone (humerus) in the accident:

He had a plate and screws put in his arm.

ESIS/ACE insured the rental car. However, ESIS did not make Zach’s mother a settlement offer.

Thus, she searched for a lawyer for Zach’s rear end accident claim. She got a free consultation from me.

Let Me Fight to Get You a Fair Settlement

I made a claim against the driver of the rental car that Zach was in.

ESIS’ first offer to me was for $125,000.

Zach healed very well. Within just a few months after the accident, he didn’t have any pain.

He did have a scar on the back of his arm:

Through intense negotiation, I settled Zach’s case for $170,000.

Here is a comparison between the first and final offer:

Most of the settlement was for pain and suffering.

After my lawyer fees, costs and paying Zach’s medical bills, I wrote him a check for $113,260.

As you may imagine, he was very happy with the settlement.

$100,000 Rear End Collision Settlement in 2022

Claude was driving a car on I-95 near Ormand Beach, Florida. Mar was a passenger in the car.

Claude rear ended an 18 wheeler (tractor trailer).

Look at a damage to the driver side and front of the car:

Here is a photo of the damage to the facing the passenger and front side of the car:

The hard impact caused a gash (cut) to Mar’s chin. She had a loss of consciousness.

An ambulance took Mar to the hospital. At the hospital, they diagnosed her with a collapsed lung (pneumothorax). They also used a few stitches to close up the wound on her chin.

After the accident, Mar got a FREE consultation with me to see if I could represent her in her personal injury claim. We spoke, and she quickly hired me.

I jumped into action to protect Mar’s rights.

GEICO insured the driver of the car with $100,000 in BIL coverage. Fortunately, Mar was able to return to work.

You can see the scar on her chin from this accident:

I did a thorough investigation to see if I could find additional insurance coverage. Unfortunately, there was no additional insurance coverage.

Like most Floridians, Mar did not have uninsured motorist insurance on her car, which would have likely paid additional money.

I settled Mar personal injury case with GEICO for the $100,000 insurance limits. Here is GEICO’s settlement check (redacted).

After my lawyer fees, costs and paying her medical bills, Mar got over $58,100 in her pocket!

The best part?

She is very happy with the settlement.

This photo captures Mar’s gratitude with the settlement:

$100,000 Settlement for Back Injury from Rear End Collision

Keith was driving a car in Coconut Grove, Miami, Florida. Another car crashed into the back of the car that Keith was in.

Here is a photo of the crash scene.

The crash reported listed his injuries as possible. His airbag didn’t deploy.

Keith was not transported to a hospital. After the crash, he complained of neck and back pain to his father, who was his primary care physician.

His father gave him a corticosteroid drug, Prednisone, which helps with inflammation. It improved a little bit but didn’t go away.

On the date of the crash, Keith didn’t have car insurance on his car. Thus, he couldn’t make a claim with anyone else’s personal injury protection (PIP) insurance.

Keith got a free consultation with me to see if I could be his lawyer. At that time, he did not have that much pain. Thus, he did not hire me at that time.

About eight months after the crash, Keith had terrible pain. His father ordered an MRI.

An MRI of his lumbar spine (lower back) showed a herniated disc at L5-S1. Here is the view of his herniated disc from the side.

Below is another view of the herniated disc.

This time the MRI is looking from top down.

His dad referred him to a neurosurgeon.

He had back surgery. Specifically, he had a L5-S1 hemilaminotomy, medial facetectomy and microdiskectomy, using a microsurgery.

Below is an illustration of a laminectomy (which is the most similar procedure to a laminotomy that I have an image of).

A hemilaminotomy is a surgery where a window is drilled in the bone through which the nerve root and disc are accessed. A herniated disc is typically removed through such a bony opening. Neurosurgeons often perform such procedures under an operating microscope.

As I mentioned, Keith also had a microdiskectomy. Here is an illustration of a discectomy.

Keith was given general anesthesia for the surgery.

His health insurance paid for most of his medical bills. Keith’s health insurance was through his employer.

Keith Had Lost Wages For Not Being Able to Work After the Surgery

Keith missed about 12 days of work from the surgery. He wasn’t working at the time of the accident. Thus, he couldn’t get workers compensation benefits. His employer didn’t compensate him for these lost wages.

He didn’t have short term disability insurance.

This is in the incision from the surgery.

He was left with a scar on his lower back from the surgery.

You may be wondering:

A scar on your lower back isn’t worth as much as a scar on a your face. Also, a scar on a man isn’t worth as much as the same scar on a woman.

Keith contacted me again and told me that he had surgery. I gave him another free consultation to see if I could be his attorney. Right after we spoke, he hired me as his injury lawyer.

Next, I jumped into action and began working on this rear end accident case.

I sent State Farm a written request to give me certain insurance information required by Florida Statute 627.4137.

The At Fault Driver Had $100K in BIL Insurance

State Farm replied, in writing, stating that it insured the careless driver with $100,000 in bodily injury liability (BIL) insurance limits.

I had to convince State Farm to pay the $100,000 insurance limtis.

Eventually, our persistence paid off.

State Farm offered the $100,000 limits.

Here is the $100,000 settlement check:

This payout is much higher than the average settlement for a rear end car accident.

I mentioned earlier that his health insurance paid most of his bills.

The health insurance company had a right to get paid back from the settlement.

Since he worked for a smaller company, the health plan wasn’t self-funded.

Why does this matter?

Since the plan wasn’t self-funded, they had to reduce their lien (claim) by my attorney’s fees and costs.

It gets better:

They also had to reduce by any other equitable factors. I argued that because State Farm’s policy was only $100,000, it didn’t compensate Keith fully for his back surgery.

Bottom line:

His health insurance company claimed a lien of $4,744.93. I got them to accept $1,265.31 to settle their lien.

Neither Keith, nor the vehicle that he was in, had uninsured/underinsured motorist insurance.

$98,735 of the $100,000 this rear end car accident settlement was for pain and suffering. In other words, 99% of this settlement was for Keith’s settlement was for pain and suffering damages.

After my lawyer fees and costs, and me paying Keith’s final out of pocket medical bills and health insurance company back, I sent him a check for $65,387.

Basically, this $100,000 settlement was 79 times the final out of pocket medical bills and health insurance lien that I paid.

Keith picked up his $100,000 settlement check at my office in Coral Gables, Miami-Dade County, Florida.

Here is a photo of us:

He was very happy with his settlement.

$100K Settlement (Truck Crashes Into Back Of Her Car)

A lady was driving her car. A truck driver crashed into the back of her car.

It happened in Miami, Florida. My client, the lady, had lower back surgery. The procedure was a percutaneous discectomy.

Liberty Mutual was the bodily injury (“BI”) liability insurer for the truck.

Liberty Mutual paid its $100,000 BI liability limits. My client didn’t have uninsured motorist (“UM”) insurance.

$70K Rear End Collision Settlement (Lyft Accident)

Mike (not real name) was a passenger in a Lyft car in Miami Shores, Florida. The Lyft car was stopped in traffic.

Another car attempted to stop, but was not able to due to a wet roadway. The other vehicle crashed into the back of the Lyft car.

Police came to the scene. The police report said that the Lyft passenger complained of very minor neck pains, but refused an ambulance.

On the day of the accident, Mike went to the hospital.

There, he had a CT scan of his brain and neck.

This is what a CT scan looks like:

Fortunately, the CT scan did not find anything wrong with his brain or neck.

He did not have health insurance, and did not want to have unpaid medical bills.

After he left the hospital, he searched for a lawyer for this rear end collision case. He found and hired me as his attorney.

He wanted to get treatment for his neck, back, wrist and foot. Thus, I sent him to a medical group in Miami, Florida. They treated him.

He had an MRI of his neck, back, wrist and ankle.

The MRI of his wrist showed mild fraying or a partial tear of triangular fibrocartilage (TFC), which is located in the wrist.

The ankle MRI showed the following:

1. Tenosynovitis of the posterior tibial tendon. (Tenosynovitis is inflammation of the lining of the sheath that surrounds a tendon (the cord that joins muscle to bone). There may be mild fraying at the posterior margin of the distal tendon. There is no full thickness or high-grade tear demonstrated.

The MRI of the ankle also showed:

2. Mild tenosynovitis of the peroneal tendons.

3. Mild plantar fasciitis. (This is an inflammation of a thick band of tissue that connects the heel bone to the toes.)

The ankle MRI also showed subarticular edema and cystic changes within the lateral aspect of the talar dome with subjacent articular cartilage loss.

Edema is swelling caused by excess fluid trapped in your body’s tissues. The top of the talus is dome-shaped. It’s called the talar dome.

You can see the talus below:

We claimed the crash caused or worsened his neck, back, wrist and ankle injuries.

He did not have a herniated disc. He did not have surgery.

GEICO sent me the $25K limits in just 1 month!

GEICO insured the other car with $25,000 in bodily injury liability (BIL) insurance.

It gets better:

GEICO issued a $25,000 settlement check within just one month after the accident!

You might be wondering:

Why did GEICO send us a $25,000 check so fast?

They quickly issued a check because the GEICO insurance policy had low limits relative to my client’s injuries. Additionally, the driver (who GEICO insured) receiving a ticket for driving too fast for the conditions.

However, GEICO’s $25K check wasn’t enough to compensate my client for his injuries. If we had to sue Lyft’s underinsured motorist insurance company, I wanted to keep this case in state court. Therefore, I did not deposit GEICO’s settlement check.

Next, I made a underinsured motorist insurance claim with Lyft’s insurance company. At the time, Lyft had $1 million dollars of underinsured (UIM) motorist insurance that covered its passengers.

Those were the days! (Sadly, Lyft has dropped their uninsured motorist insurance coverage).

At the time of this accident, Zurich American Insurance Company insured Lyft. York Risk Services Group handled the claim for Zurich.

Zurich paid us $45,000 to settle the passenger’s UIM insurance claim.

In his 5 star review on Google Maps, here is what my client said about me as his Lyft accident attorney.

Justin is fast and effective by being ALL THE TIME one step ahead of potential issues with your case. I was impressed with his accurate and rapid responsiveness even for a single phone call or email.. He’s an EXTRAORDINARY professional and human being…two qualities hard to find in a lawyer. I’m positive about referring Justin to everyone.

My actual client (Lyft passenger) review on Google Maps

Driver Gets $65K Settlement for Rear End Car Accident

Antonella (not real name) was on vacation in Orlando, Florida. She was driving a rental car. A van rear ended her.

You can see the damage to the car that she was driving:

After the crash, she had shoulder pain. She searched for a lawyer to represent her in this rear end accident. She called my office and hired me.

Antonella had a left rotator cuff tear and acromioclavicular joint arthritis.

Under general anesthesia, she had a rotator cuff surgery and was left with a scar.

The van’s insurance company would offer no more than $20,000. They were really cheap.

Therefore, I sued the at fault driver and the company that he was working for. I took the deposition of the at fault driver. The van driver’s insurance company’s lawyer took my client’s deposition. Myself and the defense attorney had a hearing in person front of the judge.

We conducted written discovery. I settled her rear end collision lawsuit for $65,000.

Learn more about this $65,000 Settlement for a rotator cuff tear.

$57K Rear End Car Accident Settlement

An on-duty police officer was stopped in traffic, when another car rear ended him. The crash happened in Medley, Florida (North Miami-Dade County).

The driver who caused the accident received a ticket for following too closely. State Farm insured the careless driver.

State Farm Insurance paid us the careless driver’s $10,000 BI limits.

The officer said that the wreck caused or aggravated his bulging disc.

His Doctor Gave Him Epidural Shots

He had epidural shots to his lower back. The cop was a candidate for lower back surgery (lumbar laminectomy). He did not have surgery.

Travelers Insurance insured the police officer on his personal car. (He wasn’t using his personal car when the accident happened).

Workers compensation for the police department paid over $17,000 in indemnity (lost wages) and medical benefits.

I settled the UIM case with Travelers for $47,000. Thus, State Farm and Travelers paid a combined $57,000 for the personal injury case.

Rear End Accident Lawyer Gets $30K Settlement

Check out my $30,000 settlement after a driver was rear ended in Orlando, Florida. All of my settlements are before deduction for attorney’s fees and expenses.

Most cases result in a lower recovery. It should not be assumed that your case will have as beneficial a result.

She claimed that the accident caused a meniscus tear in her knee. USAA insured the at fault driver.

Rear End Collision Lawyer Gets $28K Settlement

In 2020, Cordario was driving his car in Flemington, Marion County, Florida. A driver rear ended Cordario’s car. This sent Cordario’s car off the side of the road where he struck a pole.

You can see the rear end damage here:

Below, you can see the damage to the front of his car when he struck the pole:

His airbag did not deploy. This was a hit and run accident.

An ambulance took Cordario to Shands Hospital in Gainesville, Florida.

Cordario had a traumatic fracture of his ulnar styloid with minimal displacement. The ulnar styloid is a bone at the end of your forearm closest to the wrist.

This was to his non-dominant arm. Every rear end accident lawyer knows that your case is worth more if your break a bone in your dominant arm. This is because it has a bigger effect on your daily activities.

Fortunately, Cordario did not need surgery for this broken bone.

This was not a serious fracture. In fact, the hospital radiologist said that the x-ray showed that he may have a small and difficult to see avulsion fracture. In other words, he was not certain that it was a fracture.

He searched for a hit and run lawyers. Cordario saw my videos and client testimonials. He called me and I gave him a free consultation.

Let Me Fight to Get You a Fair Settlement

After we spoke, he hired me. Cordario also had lower back pain. He received physical therapy for it.

Progressive insured Cordario’s car with uninsured motorist insurance. In 2021, I settled his personal injury case with Progressive for $28,000.

After my lawyer fees, costs and paying his medical bills, we gave him a check for $15,496.

He gave us this review:

Lying in the hospital bed I wasn’t even sure if i even had a case for a hit and run accident. I searched for hit and run lawyers and Justin was the first name to come up. I watched his videos and testimonies. Justin and Jenny [paralegal] were awesome. They kept me up to date during the whole process. There was never a grey area. Things got really tough financially for me and Justin came in clutch at the right time. This process was as smooth as can be. Thank you guys so much for your help.

Google 5 star review on April 12, 2021

$28K Settlement For After Tractor Trailer Driver Rear Ends Truck

Tom, a 51 year old self-employed man, was driving a box truck on I-75 in Wildwood, Sumter County, Florida. (Tom’s truck is vehicle #2 in the diagram below.)

Jose Diaz was driving a truck for Carolina National Transportation. The truck that Jose was driving is vehicle #1 in the diagram below.

American Inter-Fidelity Exchange insured Carolina National. Jose and Tom were traveling in the same direction (South). The front of Jose’s truck crashed into the back of Tom’s truck.

The police officer investigating the scene of the crash cited Jose for careless driving. The officer recreated the scene of the crash with the following drawing:

The impact was hard. Tom got an estimate of the damage to his truck. He also took photos of his truck. We sent the estimate and photos to American Inter-Fidelity Exchange.

The following photo shows the damage to the rear of Tom’s truck.

Tom didn’t take photos of Jose’s truck.

First Medical Treatment was 6 Days After the Crash

Six days after the accident, Tom went to his primary care physician. Her told his doctor that he felt pain immediately after the collision.

His pain progressively worsened. He had pain in his neck, back and elbows.

His back pain radiated (went down) into his left leg. The doctor noticed that Tom had muscle spasms.

Due to pain radiating into his leg, his doctor ordered an MRI of the lumbar spine (lower back).

The MRI showed bulging discs in his lower back.

We also claimed that the collision worsened the pre-existing chondromalacia in his knee.

Tom was driving a box truck for work. However, Allstate insured his personal vehicle. Allstate paid personal injury protection (PIP) benefits to Tom’s doctors.

He also referred Tom to an orthopaedic doctor.

His doctor gave him prescriptions for Flexeril (muscle relaxer) and Ibuprofen (pain reliever) to help ease the muscle spasms and pain.

Here is the settlement check:

Do you want me to fight the insurance company for you?

$25,000 Payout for Rear End Car Accident (In Just 30 Days!)

Odalys was a passenger was in a car accident in Hialeah, Miami-Dade County, Florida. Another car hit the back of the car that she was in.

In both the photo below, you can see that the damage to the car that Odalys was in was major.

The crash report said that she was wearing a shoulder and lap belt at the time of the crash.

An ambulance took her to the hospital from the accident scene. However, the hospital medical record said that she was unrestrained (not wearing a seat belt) at the time of the accident.

Why does this matter?

If you’re not wearing a seat belt, and you’re injured, the insurance company may offer you less money to settle your personal injury case.

At the hospital, she complained of neck pain.

There, they took X-rays were taken of her nose, chest and pelvis. CT scans were taken of her head and brain, and her neck (cervical spine).

The x-rays and the CT scans didn’t reveal any injuries.

She had a few follow up medical visits with a doctor. She had soft tissue injuries.

Shortly after this rear end accident, Odalys got a free consultation with me. After we spoke, she hired me as her attorney.

Unfortunately, Odalys wasn’t entitled to Personal Injury Protection (PIP) insurance. This is because she didn’t own a car, or live with a relative who owned a car.

The driver of the car that Odalys was in – at the time of the crash – gave an Infinity Car Insurance card to the police officer.

I made a claim with Infinity, who said that the owner failed to add the car to the existing insurance policy. Thus, Infinity denied the claim.

This meant that the medical bills needed to be paid from the personal injury settlement, which I’ll discuss shortly.

Hospital Lowered Bill from $16,500 to $7,500

The hospital bill was over $16,500. We asked them to reduce it. They reduced it to $7,500.

Auto Club South Insurance Company insured the careless driver. He had a $25,000 per person/$50,000 per accident BIL policy. The Auto Club claims adjuster was Stephanie Schmitt.

I reminded her that she had a duty to act in good faith to her insured. I also pointed out to her that there was limited insurance coverage.

Auto Club hired attorney Andrew Stone of Stone, Glass & Connelly to decide how to divide up the $50,000 per accident BIL insurance limits.

They paid $25,000 to Odalys to settle. This is the maximum that any one person injured in the accident could get from Auto Club.

I got AAA to issue the settlement check within 30 days of the accident. You can see the check below:

The settlement is higher than the average settlement for a rear end crash. There were 4 reasons for this:

- There was major damage to the car that she was in.

- She had a big hospital bill.

- AAA is a decent car insurance company.

- There were 3 people in the car that Odalys was in.

Most of the settlement was for her pain and suffering.

$20K Settlement for Rear End Car Accident

Cesar was driving his minivan on his way to his condo in Brickell, Florida. Brickell is near Downtown Miami. Cesar was on the road outside of his condo and was about to enter the driveway.

A driver of a car crashed into the back of Cesar’s van. This impact sent him (and his minivan) into a concrete wall at the entrance. This was a second impact.

In the actual diagram from the Florida traffic crash report, Cesar was driving VEH 2:

In sum, this was a heavy impact accident. The van’s airbags deployed.

Here is what Cesar’s minivan looked like after the crash:

The driver of the (other) car got a ticket for careless driving.

Paramedics arrived to the accident scene. They placed him on a backboard and put a C-collar on his neck. They transported Cesar to the hospital. At the hospital, he was placed on a rolling bed.

Here is a photo:

Take Photos if Paramedics Put a “C-Collar” on Your Neck

If the paramedics put a cervical collar on your neck, ask someone to take a photo of you. It is best if the photo is taken in landscape view (sideways). This photo is powerful. It may get a car insurance company to offer you more money for pain and suffering.

Also, if the staff at the hospital puts you in a bed, get someone to take a photo of you. Again, this photo can be very powerful and help get the case settled with GEICO for fair value.

The good news for Cesar’s health?

He did not have any broken bones. Basically, he had soft tissue injuries. He had pain in his knee, neck and back. GEICO insured the car whose driver got a ticket.

After the accident, Cesar searched online for a car accident attorney near Brickell, Florida. My office is in Coral Gables, which is a 20 minute drive from Brickell.

Cesar told me that we were not the #1 or #2 result in Google’s search results for the term that he entered. In fact, before contacting my office, Cesar reached out to the law firms that appeared in the #1 and #2 search results on Google.

However, he also saw our great reviews on Google Maps. Cesar got a free consultation with me over the phone.

When we spoke, he felt that we clicked. He also said that in my videos I give an easy to understand explanation of how rear end accident cases are handled. Immediately after we spoke, I sent him my simple electronic fee contract. He hired me as his car accident lawyer.

Cesar received medical treatment for his soft tissue (neck, back and knee) injuries. However, he did not get an MRI of his spine. His orthopedic doctor felt that he did not need an MRI since his back and neck pain pretty much went away.

70% of the Settlement is for Pain and Suffering

Cesar had insurance on his van with United Auto Insurance Company (UAIC). UAIC took his recorded statement (with me also on the phone). Cesar’s personal injury protection (PIP) on his car insurance paid $10,000 to the hospital and his medical providers.

I settled Cesar’s personal injury case for $20,000. Take a look at GEICO’s car accident settlement check:

Basically, we settled the case in less than 9 months after the crash.

About 70% of the total settlement was for his pain and suffering. The rest of the settlement was for his medical bills.

Take a look:

After my attorneys fees and costs, and paying all of his medical bills, Cesar got over $7,250 in his pocket.

Check it out:

Keep in mind that this $20,000 settlement is much higher than the average rear end accident settlement in Florida. Why is it much higher?

For two reasons.

First, Cesar’s van sustained a huge amount of damage. Car insurance companies pay more money for pain and suffering if your vehicle is badly damaged.

Second, an ambulance took him to the hospital from the accident scene. Car insurance companies) pays more money for pain and suffering if you take an ambulance to the hospital from the accident scene.

Cesar told us that we did a Good job. Here is a photo of him smiling after he came to my office (in Coral Gables) to get his settlement check:

We likely would have gotten a bigger settlement if he would have had an MRI of his neck and/or back. However, the doctor did not feel that this was necessary.

Why not?

His pain did not shoot down to his arms or legs, and his localized back pain was not severe.

$17K Rear End Accident Settlement

Learn about a lady in her early 20’s who got a $17,000 settlement after another driver rear ended her. She claimed the crash caused two herniated discs.

Those are just a few of my hundred+ rear end car accident settlements.

$10,000 Rear End Car Accident Settlement

Lamar was driving his car in a Wendy’s drive thru lane in Oakland Park, Broward County, Florida.

Joan was driving a car and crashed into the back of Lamar’s car. After the crash, Lamar took this photo of the damage to his car.

As you can see from the photo, this was a big hit.

I’ve repeated this over and over:

Big property damage often leads to a bigger car accident settlement.

On the crash report, the owner of the car that Ashley was driving was PV Holding. PV Holding is the parent company for Avis Rent a Car.

After the car accident, Lamar went to the hospital. He then followed up with a doctor and got therapy.

Segwick handled the claim for Avis Car Rental. I sent a letter requesting the bodily injury liability coverage on the rental car.

Avis responded with their insurance disclosure under oath. We learned that Ashley was not the person who rented the car. Eugene had rented the car.

74% of the car accident settlement was for pain and suffering

When Eugene rented the car, he did not list Ashley as an additional driver. And since Ashley wasn’t married to Eugene, Sedgwick did not offer bodily injury liability coverage above $10,000. Unfortunately, this is the law.

This is true even though Eugune purchased Additional Liability Insurance (ALI) with Avis.

In January 2020, I reached a car accident settlement with Sedgwick for its $10,000 policy limits. Here is the check:

This is the most that we could get. Unfortunately, there was no other additional insurance available. Approximately $7,400 of the total settlement was for Lamar’s pain and suffering.

After my attorney’s fees and costs, and paying his medical bills, Lamar got over $4,000 in his pocket. And his attorney (me) did all the work. He was very happy with the car accident settlement.

He gave my law firm the following 5 star review on Google maps:

My experience was amazing. Justin and Jenny are very thorough and also A+ with communication. Every step of the way, Justin has been informative and doesn’t not mind educating you on your rights.

I would highly recommend this firm to anyone seeking justice. Their number should definitely be in your Rolodex.

Google Maps review (2020)

Rear End Car Accident Lawyer Gets $10K Settlement

Michelle (not real name) was driving her SUV. Another driver crashed into the rear of Michelle’s car.

As a result, Michelle’s SUV crashed into a bus in front of her.

You can see the front end damage to Michelle’s SUV.

Here is the diagram of this collision:

GEICO insured the driver who caused the crash. My client had soft tissue injuries. We settled this case for GEICO’s $10,000 bodily injury coverage limit. This is one of my many GEICO car accident settlements.

Rear End Accident Lawyer Gets $10K Settlement

In 2015, Diecson was driving his car in Miami Beach. In this collision, a driver a rear ended Diescon’s car.

You can see that there was little damage to the rear of his car.

Diecson had knee pain. He searched the internet for a rear end accident lawyer. He found we and I gave him a free consultation. Diecson hired me.

Our client’s doctor diagnosed him with a knee injury (meniscus tear). He had arthroscopic surgery, in his native country, to fix it.

Allstate insured the careless driver. Infinity Auto Insurance insured our client with PIP.

We settled this case in July 2015.

Example 1- Typical Rear End Accident

You are stopped at a red traffic light in Coral Gables (or any city in Florida) and another vehicle (truck, car, etc.) hits the back of your car.

You suffer a rotator cuff tear in your shoulder. If the rear driver says that you did nothing wrong, then the rear driver is negligent (at fault).

This is a clear liability case where the driver – or owner – of the rear car will be liable (responsible) for 100% of your damages (injuries, car damage, etc.). If the rear driver was working at the time of the incident, his or her employer will also be liable.

The auto insurer for the rear vehicle should pay for the damage to your car under the property damage/physical damage portion of his or her auto insurance. The insurer should pay for your personal injury under the bodily injury liability coverage in his or her policy.

Since you were in a car at the time of the crash, in order to get money for pain and suffering, you need to show that you have a permanent injury.

Since you were in a car at the time of the crash, your Personal Injury Protection (P.I.P.) coverage on your auto insurance policy will pay for some of your medical bills. P.I.P. may also pay some of your lost wages if you missed work.

So you may be able recover money for pain and suffering for your rotator cuff tear as well as other damages.

Example #2 – Rear Car Says Front Car Slammed on Brakes

You are stopped at a red traffic light in Miami (or any city in Florida) and a rear vehicle (truck, car, etc.) hits the back of your car. The rear driver says that the light was green and all the cars in your traffic lane were moving and you slammed on the brakes.

The rear driver says that there was nothing that should have caused you to stop. In this case it is possible that you may have some fault there is a chance that a jury may find that the rear driver is not liable for any damages.

Since you were in a car at the time of the crash, your Personal Injury Protection (P.I.P.) coverage on your auto insurance policy will pay for some of your medical bills. P.I.P. may also pay some of your lost wages if you missed work.

In this case, the bodily injury liability auto insurer for the rear vehicle may not pay you 100% of your personal injury and property damage and will argue that your damages should be reduced by your comparative fault for slamming on the brakes for no reason.

So, if we assume that you were diagnosed with a herniated disc or bulging disc from the accident, and you were evaluating the settlement value of your case, you may want to reduce the full settlement value of the pain and suffering for a herniated disc or a bulging disc – and the other damages that you may be entitled to – by your possible percentage of fault as well as other factors.

How much are Uber and Lyft rear end accident cases worth?

Let’s assume that an Uber or Lyft driver rear ends you. If that happens, the Uber or Lyft driver will likely have more bodily injury liability insurance than most other drivers.

This is especially true if the Uber or Lyft driver was engaged in a ride. In that instance, Uber and Lyft are required to have $1 million in liability coverage.

Here is an image that shows how much insurance rideshare drivers with Uber carry:

That $1 million limit will cover 99% of cases where an Uber driver rear ends you and you are injured. Your best chance at getting a big Uber car accident settlement is if the Uber driver rear ended you, and you have serious injuries. If you have big injuries, be sure to hire an Uber accident lawyer quickly after the crash.

Why Rear-End Crash Big Rig Cases Are Different

If you crashed your car into the back of a big truck, you may have a case. I’m referring to big trucks like tractor-trailers, which some people call 18 wheelers. I’m not talking about pickup trucks.

Even if the driver of the car gets a ticket for careless driving or following too closely, he or she may still have a case.

This is because many regulations apply to the back (rear) and undercarriage of a semi trucks.

In order for the driver of the car to have a case for hitting the back of a big truck, the driver usually has to be badly hurt to make the case worthwhile.

Rear End Accident Lawyer Wins $244K for Family of Passenger, and $75K for Driver

This isn’t my case. Persaud v. Cortes, Fla: Dist. Court of Appeals, 5th Dist. 2017 arose from a November 2008 accident.

Persaud’s vehicle rear-ended a vehicle operated by Santiago and occupied by 20 year old Joshua Batista, Barbara Cortes’s son.

Santiago’s vehicle then struck a third vehicle before flipping into an adjacent median. The accident resulted in Batista’s death, and significant injury to Santiago. Persaud received two convictions for DUI manslaughter.

Barbara Cortes, as personal representative of the estate of Joshua Batista, and on behalf of his survivors, and Andrew Santiago, sued Visnu Persaud.

Joshua Batista was survived by a young boy, Lorenzo, and Joshua’s parents. Cortes amended the lawsuit to include a claim for punitive damages.

She claimed that at the time of the crash, Persaud had consumed a large amount of alcohol – resulting in a .302 percent blood alcohol reading.

Joshua’s son, Lorenzo, was awarded $25,000 in pain and suffering from the date of the accident to trial, and $150,000 for future pain and suffering.

Joshua’s parents, Barbara and Hector, were each awarded $20,000 for past pain and suffering. They were awarded $10,000 in future pain and suffering.

I don’t know why the wrongful death award was so small. I don’t know the relationship between the decedent and his survivors.

Perhaps the survivors didn’t have a close relationship with the decedent, Batista. This is just a guess.

The jury also awarded $5,419.00 in funeral expenses.

The jury also awarded $75,144.35 for Santiago’s injuries.

Court Lets Motorcyclist’s Case Go to Trial Where Motorcyclist Rear Ends Car after Car Cuts in Front and Slams on Brakes

See why a Fort Myers, Fla. court didn’t dismiss a motorcyclist’s case. He crashed into the back of a car.

He said it changed lanes and slammed on brakes.

Court Puts Zero Blame on Front Car in Rear End Crash

Ferrel L. Bodiford sued Kenyattos Andre Rollins. The District Court of Appeal of Florida, Fifth District issued an opinion on August 7, 2015.

Florida’s Fifth District Court of Appeal is comprised of Hernando, Lake, Marion, Citrus and Sumter Counties, Flagler, Putnam, St. Johns and Volusia Counties, Orange and Osceola Counties, Brevard and Seminole Counties.

A Orlando lawyer represented Rollins. Fort Lauderdale attorneys represented Bodiford, the negligent driver.

Facts

Kenyattos Andre Rollins sustained significant injuries when he was rear-ended by Ferrel Bodiford while Rollins was waiting for traffic to clear to make a left turn. A jury verdict awarded Rollins damages in excess of one million dollars.

The jury found Rollins thirty percent at fault for the accident. Rollins appealed, arguing that there was no basis for the jury’s finding that he was thirty percent at fault for the accident.

The appeals court agreed with Rollins. There was no evidence showing that Rollins breached any legal duty or failed to use reasonable care. Thus, there was no evidence to support the jury’s finding that Rollins was negligent and comparatively at fault for the accident.

The appeals court cited the following cases:

Birge v. Charron, 107 So. 3d 350, 360 (Fla. 2012) (clarifying that to apportion fault to front driver in rear-end collision requires evidence that front driver “was negligent and comparatively at fault in causing the collision”)

Pierce v. Progressive Am. Ins. Co., 582 So. 2d 712, 714 (Fla. 5th DCA 1991)

Pierce held that in rear-end collision, rear driver has the burden to rebut presumption of rear driver negligence by producing evidence of substantial and reasonable explanation that rebuts presumption).

This case is Bodiford v. Rollins, Fla: Dist. Court of Appeals, 5th Dist. 2015. Learn more about Florida car accident cases with Progressive Insurance.

Did someone’s carelessness cause your injury in a Florida car crash or other type of accident?

I Want to Be Your Rear End Accident Lawyer in Florida

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.